SAVES TIME

How Ai is changing loan origination

In the competitive world of lending, speed, accuracy, and efficiency are key. AI loan origination systems are transforming the way financial institutions manage the loan lifecycle, from application to approval and beyond.

90% faster loan origination time by automating manual processes

Manual processes have long been a bottleneck in the loan origination cycle, leading to delays, errors, and increased costs. Automated loan origination systems powered by AI address these challenges by automating tasks such as document review, verification, and underwriting. This automation not only reduces the time and effort required to process loans but also significantly increases efficiency.

Process Bank Statements, 1099s, tax forms and other documents in seconds

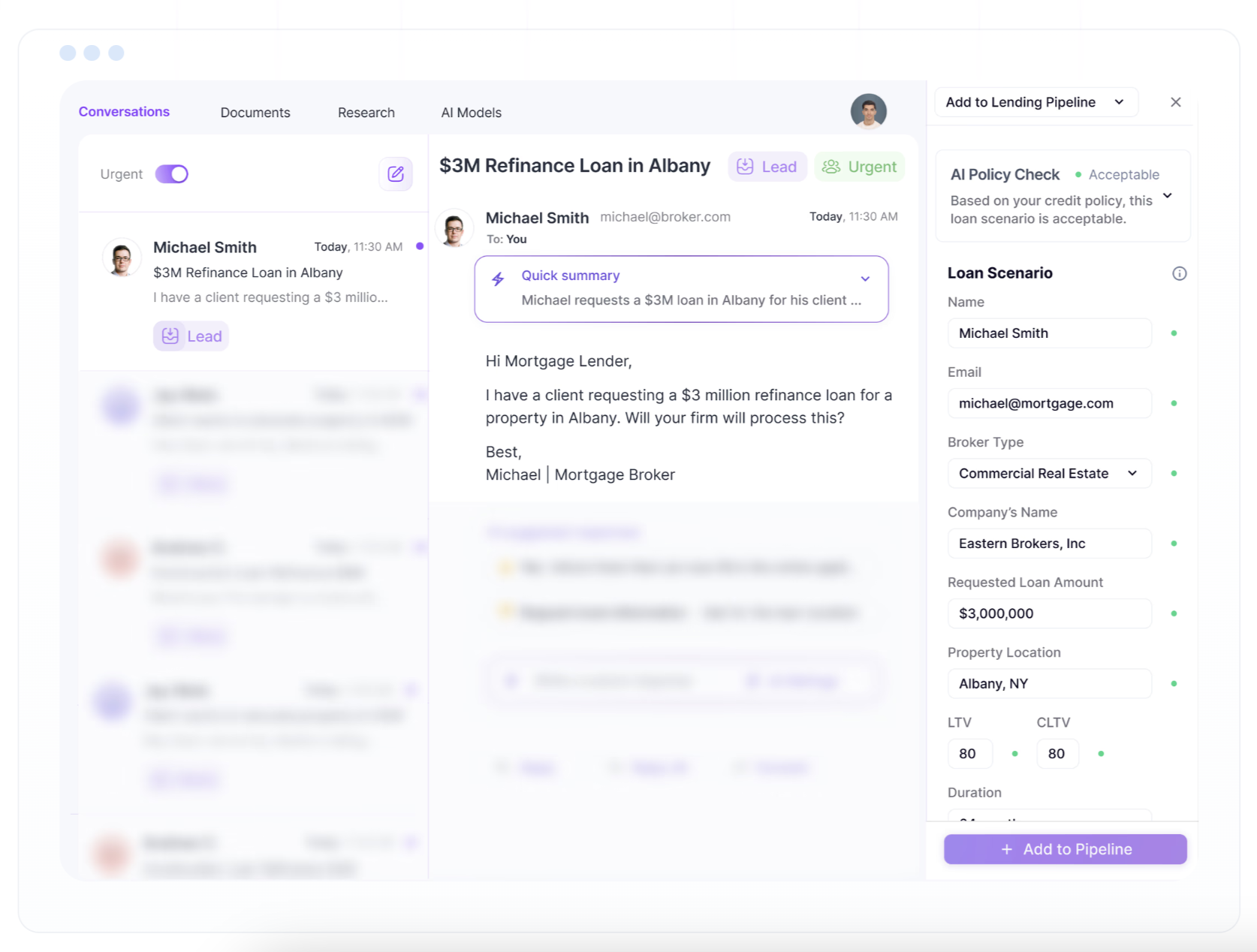

Automate data capture to speed up the loan origination process from weeks to days. Extract borrower information from complex documents that contain text, images, tables, and other data formats instantly. Using AI, lenders can use natural language to find the information needed for decision-making in seconds. Data can be synced with CRM or other loan origination system for a more unified workflow

AI-Powered Credit Decisioning

AI-powered credit decisioning is a game-changer in the loan origination process. Traditional credit assessments often rely on manual reviews and outdated scoring models, leading to slow decisions and inconsistencies. AI transforms this process by providing instant, accurate credit assessments. Advanced algorithms analyze large datasets, taking into account a wide range of factors to deliver precise credit assessment in seconds.

Automate follow up with brokers and borrowers

Most loan officers spend a lot of time following up with leads (brokers and borrowers). Such as asking leads to upload missing documents. This can sometimes take up to 80% of their time. AI can create personalized follow-up messages and send them automatically. This can save a lot of time and increase lead conversion rate by over 70% and increase customer satisfaction.

RESULTS

What early adopters are saying

Early adopters of using Ai in the loan origination process are experiencing tremendous benefits in the form of faster approvals, lower costs, and higher borrower satisfaction.

Loans can now be closed in days instead of weeks, and the entire process is more transparent and efficient. Borrowers are happier, and lenders are saving time and money. It's a win-win for everyone involved.

Loan officers no longer have to spend hours reviewing documents, verifying information, and manually processing applications. Instead, they can focus on building relationships with borrowers and growing their business.

Start Closing More Loans TodayAI loan origination has completely transformed our operations. We've seen faster approvals, reduced costs, and a better overall borrower experience. It's a game-changer for our lending process.

TRUSTED

Leading lenders and banks are already using Ai Loan Origination to improve their lending process.

Top lenders and banks are already equiping their loan officers with modern AI technology for faster loan origination. Will you join them or be left behind?